Trading Using Retracements back up to a Notable Price Level

August 6, 2014

One of the nice things about pivot points that are spaced far apart is that the market will tend to be sensitive to them to a greater degree. When there is no other obvious immediate intraday level for price to hang on, it makes reaching a pivot point a rather notable event, as many buy/sell orders will tend to be located there.

Also, as an individual trader, it is much more pleasant not having to watch the market the entire time when this is the case. I simply set a price alert at both the pivot level (which didn’t come into play) and support 1 (1.33422). That’s not to say I didn’t check the chart periodically, as occasionally price levels set up on their own from the mere congestion of price action, as I wrote about recently.

But in this case, after 4:30AM EST was mainly just a clear downtrend, with a thirty-pip drop in two hours. I am not one to hop in with the trend on seemingly random entries, as some traders have done successfully. It’s not something I’ve ever been able to do very well, so I stick with what I happen to be useful at trading-wise.

Notably, I enjoy trading with the general direction the trend, on pullbacks up to recent levels of support and resistance. And always, when I say trend, I mean relevant to the particular timeframe you’re looking at. Trend is often a source of confusion for traders so I feel it’s essential to clarify. You can be in a downtrend on a five-minute chart, yet be on an uptrend on the daily chart. But when you’re trading short-term binary options (as in only a matter of minutes long), the trend on the five-minute chart is going to be much more pertinent to your particular trading scenario.

Either way, the EUR/USD has been in a bit of a downtrend recently overall across several trading days. With the downtrend this morning, it made put options the most attractive.

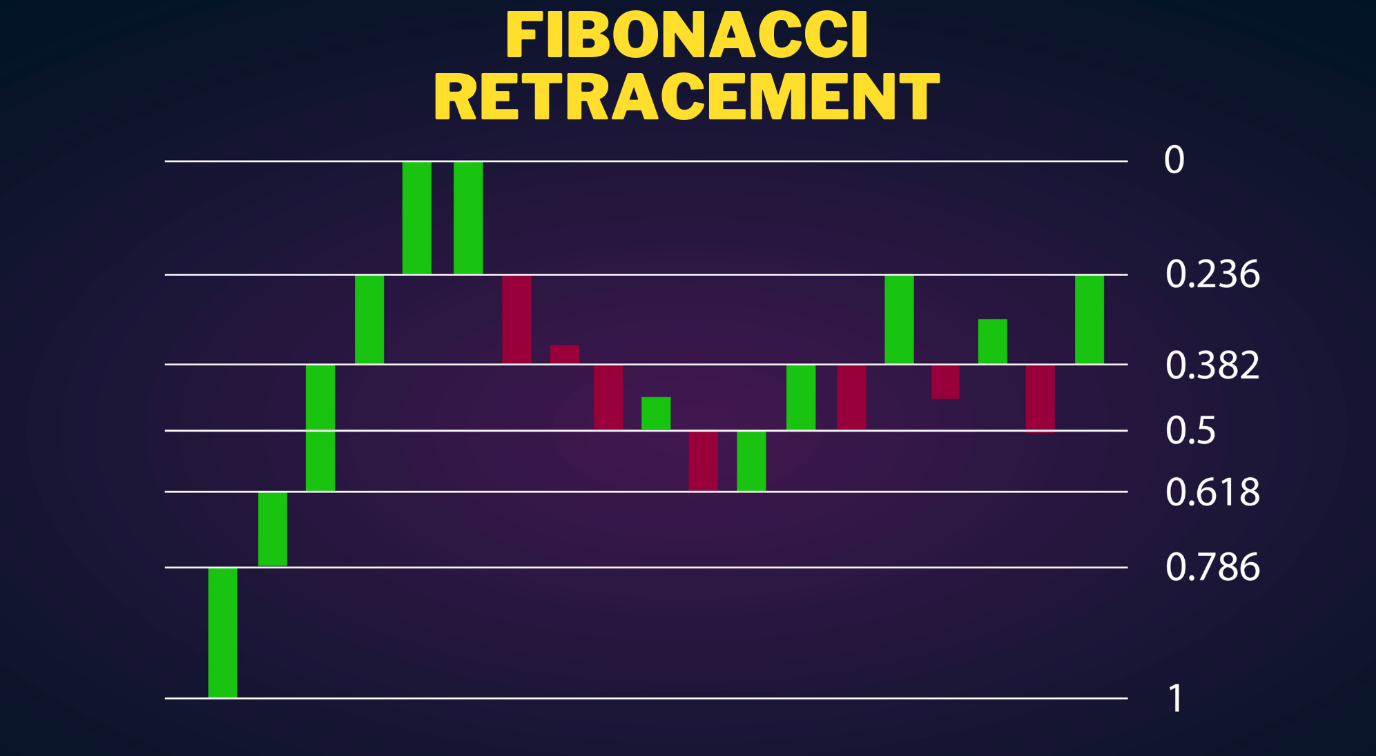

When it reached down to support 1, 1.33422, it closed below that level, but had a brief rebound. In the not-so-recent past, I had a reader question about this particular market phenomenon. Since I always look for trades at rejections of price levels, I don’t consider trades where there is a break and close below the level, followed by a boost back above, and a subsequent touch. An example is below:

I’m looking for a touch, rejection, and close back above on the same candle. It may seem like an arbitrary rule of sorts. After all, where a candle closes is determined based on what time it happens to be. But it actually does have some basis in the trading decisions of those who actually influence the market. And as individual traders, it is our job to identify what the big players in the market are up to and piggyback on the resultant moves in the market.

Moreover, while I believe trading must be discretionary in some form, I feel having some type of rules as part of your trading plan can actually be beneficial to limit confusion and emotional trading decisions.

The market eventually did break under 1.33422 on the 6:30 candle, and even came back up to reject it as a resistance level on the 6:40.

At this point, I was looking toward 1.33422 as a place for put options. The hope, of course, was to see a retracement back up to 1.33422 with the prevailing downtrend serving its use to reject support 1 for a put option winner. It seemed like a reasonable plan.

When the market crawled back up to support 1 and eventually touched and rejected on the 7:00 candle, I looked toward a re-touch on the following candle as a signal to get into the put option. Given that the market was a mere fraction of a pip away, it was very likely to re-hit the level very soon, which it did. I got into the trade at just above the intended entry point of 1.33422, which I can never complain about because it does give the trade a little bit of extra room.

This trade was not in my favor the entire time. It was against me for much of the early part. But I did get a nice bearish 7:10 candle to give four pips in favor, before settling out as a 1-2 pip winner by expiration.

And that was it for the day. Another 1/1 ITM day. The trade that I wanted and planned out well ahead of time set up well and I was able to take advantage.