Trading the USD/CHF on July 25, 2013: 3/4 ITM

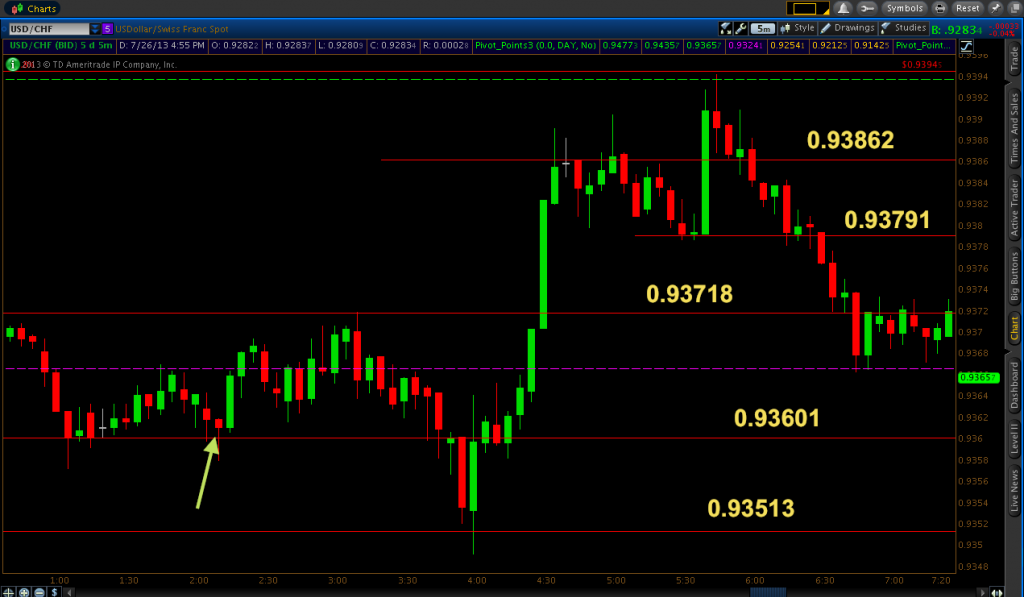

I traded four set-ups on the USD/CHF on Thursday, over the course of a trading window spanning from about 1:30AM-6:30AM EST. You’ll notice in my screenshots that I have more red horizontal price level lines than usual, but two of them are actually from the previous day – 0.93513 and 0.93718 – both levels at which I took actual trades. I usually leave in these red lines on my chart for the next trading day but if the market has drifted far from these levels or price is showing no sensitivity to them, then I will delete them.

The first set-up I strongly considered trading was a put option at the pivot level of 0.93666 (purple line on the chart). It came up and touched on the 1:45 candlestick before wicking back down. I was looking to enter a trade on the touch of the pivot level on any following candles, but it didn’t quite get back up there before it made its move back down to the nearest support level of 0.93601.

The market had formed some support at 0.93601 just after 1AM and bounced off the level again on the 2:05 candle. Therefore, being this was a valid price action signal that confirmed strength in the support level, I decided to take a call option at the touch of 0.93601 on the 2:10 candle. This turned out to be a strong trade and even broke previous short-term resistance at the pivot point for about a nine-pip winner.

Thereafter, price continued to meander around the pivot level, but it was no longer acting as a robust price barrier on which trades could set-up. However, on the 3:40 candle, price returned back down to the 0.93601 support level, and wicked back above by about four pips. Based on the price data that was sitting in front of me, it appeared as if a channel was forming between 0.93601 and 0.93718, one of my trading levels from the previous day. Once price re-touched 0.93601 on the 3:45 candle, I entered a call option for a 4:00 expiry. The market continued to break lower, however, and this trade lost by about seven pips.

Shortly after the expiry of that trade, price came down and touched another one of yesterday’s trading levels, 0.93513, before making a strong 30+-pip climb in about a half-hour, breaking through previous resistance points of 0.93601, the pivot level of 0.93666, and 0.93718. If the upward boost was very strong, I figured it might go all the way up to where the resistance 1 level of 0.93937 (green line) and 61.8% Fibonacci retracement line of 0.93945 (drawn from the price move from 0.91748-0.97500) nearly overlapped. However, it ran into resistance at 0.93862, wicking strongly on the 4:35 candlestick, and forming a doji and bearish engulfing candle on successive candlesticks.

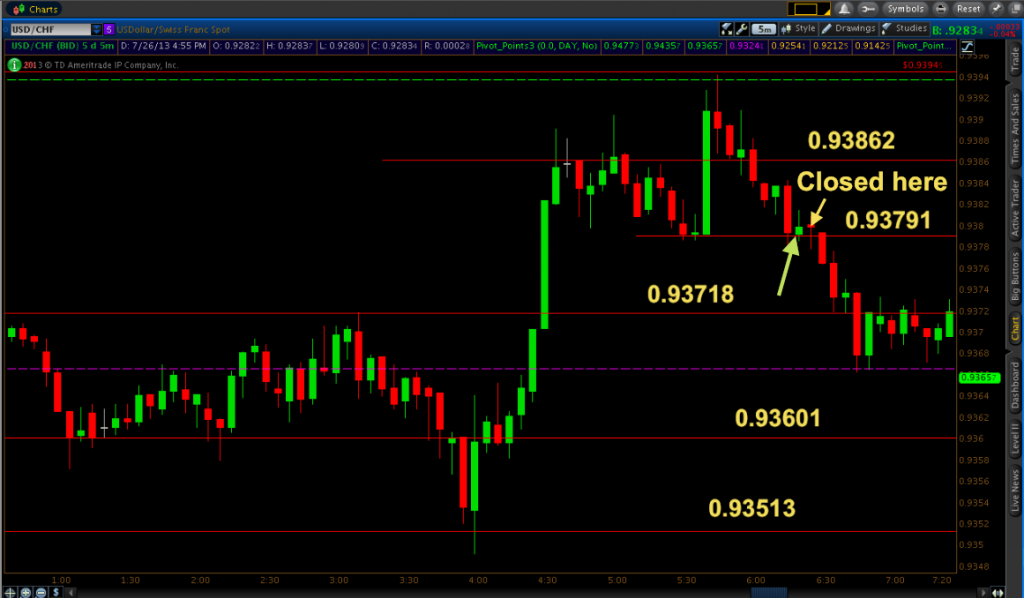

Price retraced back down from the new resistance by about seven pips before coming back up to 0.93862 on the 4:55 candle before wicking back down. Although the pair was clearly undergoing a strong uptrend over the past hour, I felt that the level was strong enough to at least support another short-term bounce back down. When price came back up and re-touched 0.93862 on the 5:00 candle I entered a put option. This trade did initially go against me by about four pips, but it eventually closed out as a six-pip winner.

Price came back down to 0.93791 before jumping and closing above the 0.93862 resistance on the 5:40 candle. A put option at the resistance 1 level (0.93937) would have been my strongest set-up of the day, due to the confluence of an overlapping Fibonacci retracement line sitting less that one pip above it. The market did get up to resistance 1 on the 5:45 candle and bounced off, but it did not re-touch on any subsequent candles, so the put option set-up never materialized to my liking.

When price retraced back down to 0.93791 on the 6:15 candle, I began considering call options at that level. This was certainly a weak support level to be considering for trade material, as it had only one recent instance of its value as support. However, I did have the overall trend going in my favor, so I figured if the probability of the set-up was in favor of working out I might as well take the trade. Essentially that’s what trading is all about – taking advantage of opportunities in which you judge the probabilities playing in your favor. Once price re-touched 0.93791 on the 6:20 candle, I entered a call option. This trade won by about a pip, but I could consider myself somewhat lucky on this one, as it could have gone either way with the trade being in my favor just as much as it was out of my favor. And right after it closed, price continued lower back down to the pivot.

I stopped trading right after the expiry of this trade after going 3/4 in-the-money for the day. If I had continued trading, I would not have taken the pivot point trade later on anyway, as price stopped showing any direct sensitivity to it as a support or resistance level earlier in the morning.