Trading Around News Time

July 26, 2014

Trading when the news is released as a binary options trader can be risky.

In forex trading, managing risk is relatively simple in that you can adjust your stop-loss to a given pip value and if you’re wrong and your stop is hit then you’re out just a little bit. If you take trades in both directions, with relatively tight stops and take-profit levels multiple times the magnitude of these stop-losses (e.g., stop-loss of five pips in each direction, but a take-profit of twenty pips each way), then in order to win the trade all you need is for the market to move sufficiently enough in either direction.

But in trading short-term binaries on offshore brokers, the risk is already built into the instrument itself. Typically, if you lose, you’re out the 100% investment size. If you win, then you receive back your initial investment plus an addition percentage less than what you invested (usually 70%-90%). So if you invest the same amount you must win more often than you lose otherwise your bottom line will be negative. Consequently, you have to be picky in your trades because all that matters is if you win or lose, not the typical means of determining trading profitability, which is usually the extent to which you win or lose (in currency trading this is measured in pip amounts).

So if you’re trading around news time, it’s best to stay out before the announcement because technical cues tend to easily break down when news is released. Accordingly, you’re essentially left with a 50-50 shot of winning. That, as mentioned in preceding paragraph, does not represent favorable odds under this particular form of trading that I’m undertaking. And you also want to wait for the market to stabilize itself before considering further trades.

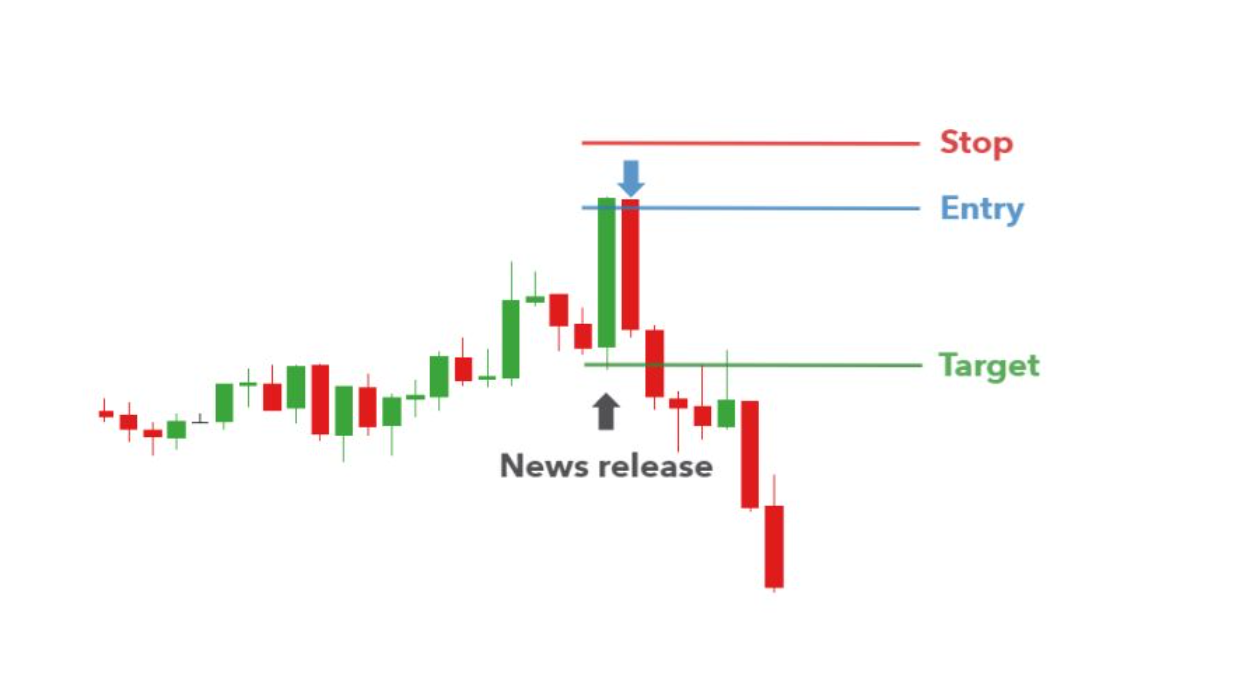

In this set up, it was directly after news time, typically 8:30AM EST for the United States, as was the case in this market situation. As you can see, just durable and cap goods data releases.

The market took the news ambivalently, going up, down, and eventually settling in the green, as can be represented by the “freak out” candle with large top and bottom wicks. Overall, it had a 15-16 pip range (from top wick to bottom wick). That’s not actually too large, given after all the news announcement is relatively minor overall.

The next candle would give a clue as to how the market would break. At this point, I was in the early stages of considering a put option at support 1 – 1.34410. The 8:40 candle gave positive info about that possibility. It did wick about three pips above, with a minimal body and short lower wick. This suggested that there was still a decent amount of buying force interested in bringing the Euro back above this level.

But it did hold, and held again on the next candle, this time with an even smaller upper wick. This was enough to suggest to me that this trade had a favorable chance of working out. So I got into a put option on the touch of 1.34410 on the 8:50 candle.

Despite this trade going against me by a couple pips early on, this ended up working fantastically. I was up by fourteen pips at one point, before settling for an eight-pip winner by expiration.

To effectively trade the news, I feel the best strategy is to simply not trade it in the sense that you wait it out and let the market regain its semblance of normality. Only when the asset shows indications that it is reclaiming its fidelity to technical cues should you begin to proceed with your trading as intended. And that’s precisely the type of thinking I took when taking the trade expounded in this particular market scenario.