Small Pivot Point Range Trading: 3/3 ITM

July 28, 2014

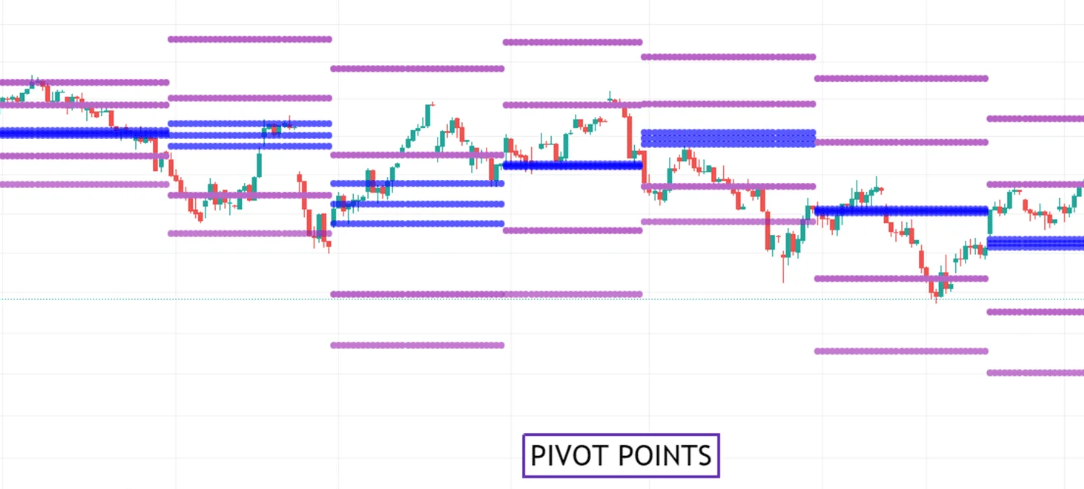

The benefits of having a tightly constricted set of pivot points is that the market may provide several areas of congestion. When they are close together, it may take only a few five-minute candlesticks before the next one is met. It really can make for an exciting and active trading session, as price tends to show a level of intraday sensitivity to pivot points, and trade set-ups can occur relatively frequently.

When the day was over, I basically had identified six main decision points in my trading from today and will address them in numerical order:

1. In this first market scenario, price breached resistance 1 and indolently sat on top of the level within a couple pips of it. As the general concept goes, old resistance can turn into new support, in the event that it’s broken (and vice versa). But in the three following candles after the break of resistance 1, the level continually held as can be seen in the image below, with a touch and rejection on each candle.

You can’t really consider it much of an uptrend here, as the market had barely moved thus far, as we were less than an hour into the start of the European session (typically taken as 2AM EST). The only uptrend-ish element we had was the break of resistance 1. But with three consecutive touch and rejections of resistance 1, I had the confidence to get into a touch of the level on the fourth consecutive re-touch on the 2:50 candle. It rejected as well, as did the next before getting a bit of a boost finally on the closing candle. This trade won by about three pips.

2. The next decision came right away, governing how to react with the resistance occuring at the resistance 2 level. It rejected on the 3:00 candle, sat below on the 3:05 before coming up to test again on the 3:10. Yet no put option trade was taken on this candle.

Firstly, the 3:00 candle represented a greater infiltration of volume into the market. Whenever there is an increase of volume into the market you need to be wary about technical-based set-ups. News time is the best illustration of this phenomenon. But it can happen in normal market scenarios as well when more traders enter the market at certain times of the day or seemingly randomly.

But the combination of the uptrending nature of the market (at least the arrow seemed to be pointing that way for the morning) and the extra volume told me that it was probably best to stay out of this one.

3. Following this, price meandered around the pivot–resistance 2 range. After that first trade, nothing cleanly set up for over two hours. Even so, I was more or less watching the chart the entire time given it could take very little time for something to set up properly.

The next possible set-up was at resistance 2 around 5AM EST. Price had touched just barely on the 4:55 candle and rejected the level. But given the breach of resistance 2 at around 3:15AM and the ongoing uptrending bias, I felt it would probably be best to sit out this opportunity. The previous break of resistance 2 was the leading factor in this decision, as price levels that are broken or not very well respected by the market necessarily hold less influence.

Just because a pivot point is there doesn’t mean that it’s important to find a way to trade it. Other factors outside of support and resistance will be the determining point (e.g., price action, trend, momentum/volatility). These price levels simply act as guides for potential trade targets.

A move up to resistance 3 seemed most likely just based on knowledge of the fact that resistance 2 had been surpassed previously and was clearly in a slow, but steady up-climb.

4. The move up toward resistance 3 did happen, and a favorable trade set-up occurred. Price went a few pips above the level on the 5:05 candle before wicking back down, followed by a doji right at resistance 3. This is pretty clear price action confirmation that a put option trade could be a pretty defendable decision.

Yet with the ongoing uptrend, in addition the the fact that the buyers had pushed price above resistance 3 initially, it still wasn’t a super set-up. I wanted more evidence that this level could actually hold, either by:

a) more congestion along that level on the next candle (preferred), or

b) a retracement back down to resistance 2 or so to show that some selling force is present.

I list option A as preferred only by the fact that if it retraces back down there could be the chance that I miss a resistance 3 trading opportunity altogether and that a retracement would delay taking the put option should it continue to be available.

To make a long story short, I did get option B. After a re-touch of resistance 3 I took a put option and had a three-pip winner.

5. This scenario is similar to #3 explained above. The trend was up for the day and there was already a break in the resistance level I had targeted. But this one I felt more confident in for a couple reasons.

First, resistance 3 tends to be a more robust trading level than resistance 2, in my personal experience. It largely has to do with the fact that resistance 3 represents a greater deviation from the mean. While it does happen, it is rare that price finishes out of its pivot point range for the day even if the pivots are relatively close together. Second, the price action simply set up better here. On the 6:20 candle, a doji formed with minimal wick above the resistance level and a close about one pip below. Upon the re-touch, I got into another put option at resistance 3 and had a nice two-pip winner by expiration.

6. In this sixth and final main decision point, I was mainly looking to take trades at the high of day represented by the white horizontal line in the image below. Considering it was a net uptrend for the day, resistance 3 had already been tested multiple times (i.e., buying is relatively strong despite the low overall market volume), and price wicked above the level on the 7:15 candle, I was content to wait for a more conservative entry for further possible put options.

In this case, I decided on the general “high-of-day” level (quotations because I didn’t precisely identify it) – the top of the previous wick which represented the top of the candle bodies from the move made between 5:45-6:00.

A put option did not subsequently set up here, but I was very happy with the way today turned out at 3/3 ITM.