Labor Day EUR/USD Trading (4/5 ITM)

September 1, 2014

Unfortunately, I’m doing this write-up a week later than I wanted to. But school often consumes a lot of my time, so naturally if I do any trading my write-ups will often be delayed until I find a spare 1-2 hours to go back and analyze the charts, take screenshots, and construct the post about it. Others might find it helpful to consult their own charts regarding the trades that I take in addition to whatever chart images I provide in the article, which also makes sense for the sake of perspective.

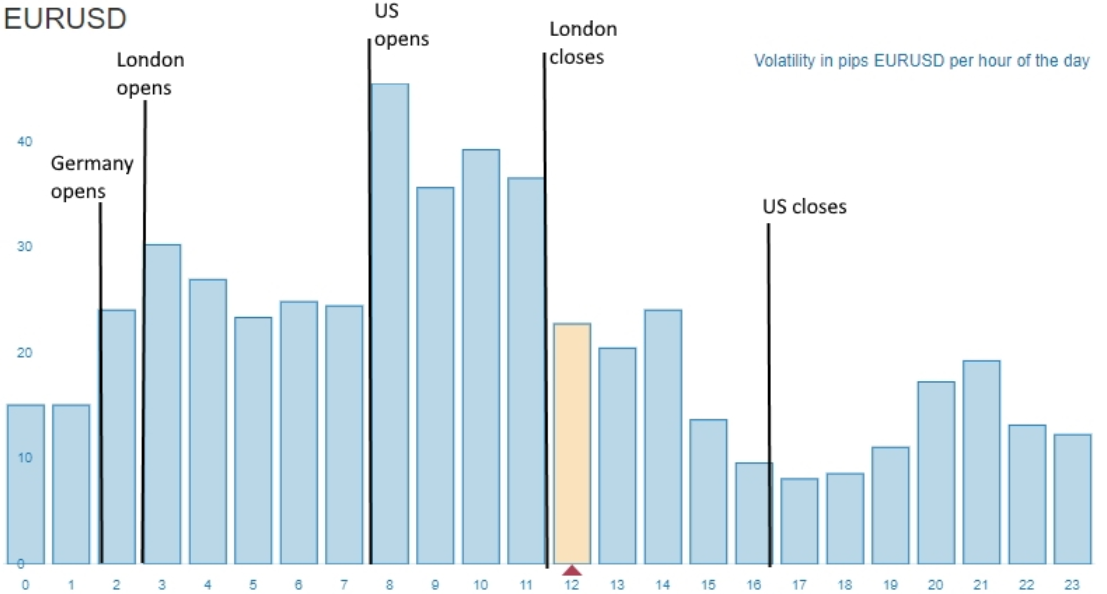

Anyhow, the U.S. Labor Day was actually a busy trading day for me. Naturally, you would expect the markets to be pretty lackadaisical given the near total absence of U.S. traders in the market, given banks and big financial institutions take the day off. Indeed, volume was naturally lighter than normal, but the market still moved relatively well despite it all. Consequently, there were an above-average number of trading opportunities that I was able to take advantage of.

Trade #1

When I began watching the EUR/USD around 2AM EST, price was coming up from its daily pivot point and approaching resistance 1. The touch of the level occurred on the 2:10 candle, but didn’t set up in the way I like to use as price action confirmation. That is, there wasn’t an immediate rejection and price closed above resistance 1.

Nevertheless, it did hold and came back down to re-touch the pivot level once again. Given this sharp rejection of pivot, I would have considered a call option on a subsequent re-touch of the level, but resistance 1 was touched on the very next candle. It is rare that you might expect a test of one daily pivot point only to have that candle touch another. But that was simply the way it was today, with the pivot and resistance 1 separated by just over five pips.

With this rejection of resistance 1 on the 2:30 candle, I got into a put option on the touch of the level on the following candle. I had a nice three-pip drop initially, but this gain was wiped out on the following candle to bring it back to break-even, before winning by a small fraction of a pip. I guess if you get nervous on the eventual outcome of trades, this would have been a real nail-biter, as it went back and forth between in-the-money and out-of-the-money during the final few minutes.

Trade #2

The market moved above resistance 1 after the close of that trade, but stalled about five pips above the level before giving the indication that it could come falling back. This, of course, would set up resistance 1 as a support level, and hence an area to consider call options, looking for a bounce back up.

After about a half-hour trickle back down, price finally touched resistance 1 and formed a small doji on the 3:40 candle. There was practically no movement on this 3:40 candle, which is a good thing in that it shows indecisiveness. And indecisiveness is always a good thing when it comes to a trading style predicated on reversals of some sort. If a market reaches a price level and stalls, that can only support the idea that there quite possibly isn’t enough overall volume in the market at the moment to break that level. Of course, more volume could enter the market and break the level, but when making trading decisions you only have the market before you on which to base these judgments.

So I got into a call option on the touch of resistance 1 on the 3:45 candle. This trade won by 2-3 pips.

Trade #3

This trade was based on the same general premise as the second trade. When it was clear that the market had a lean toward staying above resistance 1, I got into the same exact trade (touch of R1) geared for a 4:00AM expiry. Given that this trade had the same entry and expiry as the previous one, this also won by 2-3 pips.

Trade #4

After 4:15AM, the market spent the remainder of the hour ascending toward resistance 2. There seemed to be a bit of resistance in the middle of the resistance 1-resistance 2 channel, due to the brief reversal that had occurred there after 4AM, but I didn’t really expect it to hold much value and it ultimately did not.

Instead resistance 2 became the new target. When there was a nice rejection of it on the 4:50 candle, I got into a re-touch on the 4:55, for a 5:00AM expiry. Unfortunately, this trade did not hold and I lost by a bit over one pip.

Trade #5

Despite the failure of the previous trade, price showed continued sensitivity toward resistance 2 as a price level. Price never went more than 4-5 pips above it and there were two rejections on the 5:05 and 5:10 candles.

I felt at this point resistance 2 had been established as a robust support level, so on the next touch I got into a call option on the 5:20 candle. This was practically in favor the entire time and won by just over two pips.

So despite the realities of lower trading volume on a national holiday (with respect to the U.S.), I was still able to find quality set-ups to trade and wound up with a 4/5 in-the-money day.

And please, if you ever have questions for me, never hesitate to let me know and I will get back to you as soon as possible.