Identifying Horizontal Support and Resistance from Previous Price History

October 23, 2012

Support and resistance levels are essential to technical analysis as they reference areas on a chart where price has a tendency to consolidate and potentially reverse from its previous direction. You might also hear some traders refer to these as “demand zones” and “supply zones” for support and resistance, respectively. Conceptualizing it this way refers to the fact that at support, price is low (and hence drives up demand), while at resistance, price is high, which lowers demand and drives up supply. But for purposes of this post, we’ll reference these areas of price consolidation as support and resistance or simply S/R.

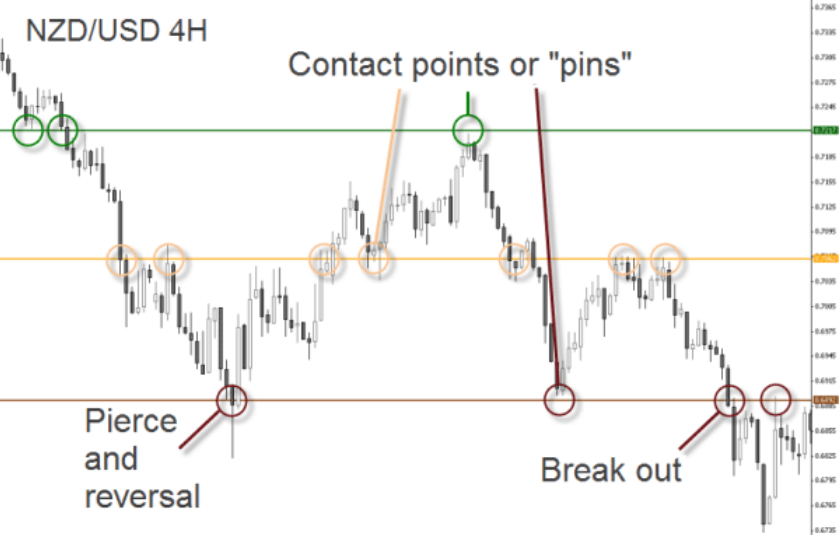

When I’m looking for S/R levels, I’m looking for an area that has been recently tested more than once and validated without being broken. Take a look at the first example:

We can see four bounces off of support in a short period of time on the USD/CAD 5-minute chart before retracing higher. Trades could have been taken at the green arrows I drew in and landed well ITM.

When looking at a market, obvious support and resistance levels should stand out pretty quickly to you after some time studying the charts. These levels are often observable as areas where price has been noticeably consolidating, often at completely different time periods on the chart. Also, these levels can denote the price extremes on the chart, or where the highest high and highest low of the price are located.

Here’s the same chart, but provides examples of what I do NOT consider to be reliable S/R levels:

Every dip and turn on a chart should not be considered as tradeable S/R. Where I’ve drawn my arrows are what might be termed “minor S/R” at least within the context of the price history that’s displayed.

Here is the most obvious example of S/R displayed on this CAD/JPY 15-minute chart:

The first wick gives indication of a price level rejection and a potential formation of a future level. Price came down and touched near that level again. Depending on the price action (which would ideally be viewed on a smaller timeframe), you could have taken a call option near that level. Further call options were later available at that price as it continued to hold.

Also note that the above chart is a 15-minute rather than the more commonly used 5-minute. Support and resistance lines are great to determine on the higher timeframes in that more noise is filtered out on the higher compressions and leaves you with more credible horizontal price levels. That said, on higher timeframes, more time is compressed into each bar so you will naturally have a lower number of S/R areas relative to the same period of time, which will likely present you with fewer trading opportunities. The tradeoff, of course, to using the higher timeframes to identify S/R is that the levels tend to be more robust and yield set-ups that have a better probability of landing in the money.

The most obvious level in the following USD/JPY example comes at the 79.793 price level:

Price formed a double bottom before retracing back up. Price action may have been favorable to produce a call option at the second touch of 79.793 (first arrow) and certainly would have been a level of interest where the second green arrow is located for another call option.

In addition, this chart nicely reflects the importance of whole numbers as S/R in trading. Notice where the USD/JPY bounced off of – 80.001, or one-tenth of a pip above the clean, whole number of 80.00, which is commonly termed “psychological resistance” in this case. On major pairs, these are very important. For example, the round figures of 1.3000, 1.4000, and 1.5000 have produced significant price consolidation on the EUR/USD in its history. The GBP/USD has had several meanderings around 1.6000 in recent weeks. The 1.2000 EUR/CHF level is probably the most robust whole number S/R in all of forex at the moment, as it’s been publicly affirmed that the Euro will not be permitted to fall below a level that’s not at least 20% greater than the Swiss Franc (CHF).

Price levels are the main thing that I consider while trading. However, to be a successful trader they cannot be traded alone. They must be considered within the context of price action, meaning using the clues from the shape and patterns of price candles to make educated guesses regarding where price might go next. Taking a trade every time price simply hits a line on your chart will eventually result in disaster. You must do more to stack the odds in your favor than simply trading horizontal lines. You must consider current momentum, short-term (e.g., past hour, four hours) and long-term trend (e.g., past day, week) if applicable, news events, and even how far you are from potential S/R in the range that you’re looking to trade into. For instance, if you’re at a good support area, but price has been steadily declining over the past couple hours with weak retracements back up, and there’s minor resistance three pips above the current price, then you’re best off staying out of the trade entirely.

Most importantly, when looking for levels, choose those that have been tested more than once. If the price action has been choppy to the point where there doesn’t seem to be any favorable S/R to trade off of, don’t simply be content to choose mediocre levels as potential trading points instead or go overboard with how many you’re visually interpreting. That will cause you to take suboptimal set-ups and dampen your accuracy (i.e., overtrading). Confluence is key in trading set-ups. If the overall trend is up, you’re at a solid support area, you have a sizable range to trade into, and the retracement that brought you to support is showing exhaustion through price action (e.g., dojis, small candles), then it sounds as if you have a high-probability set-up and are looking at a great trade.

I definitely welcome any questions, so please don’t hesitate to leave a comment below!

UPDATE 24/10/2012 – In response to lots of questions I have made a follow up post on this topic here.