EUR/USD Binary Options Trading for July 9, 2014

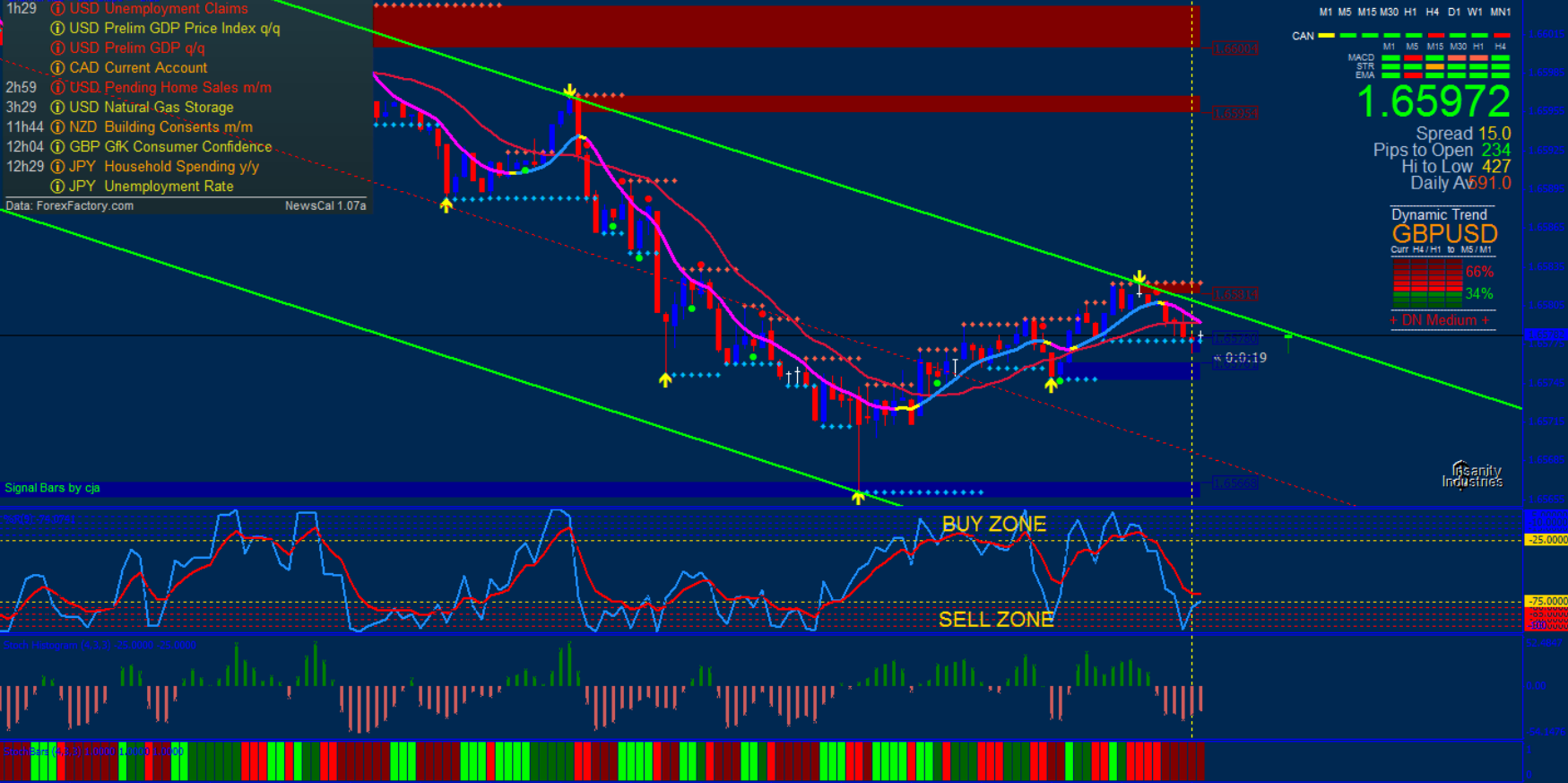

I found a solid trade set-up on the support 1 level of 1.36153. As I stated in my post on the GBP/JPY trading from yesterday, my favorite type of trades are those that go with the general trend at retracements back to recent support and resistance levels.

By “trend” in the case of short-term binaries, I mean to say where the market is heading at that particular time, normally for that morning alone. Trend is often ambiguous in the sense that it can simply be in opposing directions depending on the timeframe being used. Perhaps on the daily chart you’re in a clear multi-month uptrend yet on the five-minute chart you’re in a clear downtrend. But for binaries I like to consider the shorter-term trends for the simple fact that I’m trading shorter-term instruments. If you’re swing trading forex and holding positions for several days, weeks, or months at a time, I’d advise trading in accordance with the trend on those higher timeframes – e.g., what you might see on the daily chart. I do understand that “trend trading” can be a source of confusion for many because charts simply look different across the various timeframes of the same asset. But trading with the trend relative to the type of trades you are making makes the most sense to me. If you’re scalping the forex market for a few pips at a time or trading binary options with 15-minute expiries, then considering the trend from a shorter-term perspective works best, in my opinion.

As for today’s trade, the market had ascended about five pips above support 1 yet fell back to test the level on the 1:50 candle. The close sat roughly on 1.36153, but I was still willing to get into a call option on the 1:55 candle. There were a few things working in its favor. The rise above support 1 looked like a relatively genuine indication that it wanted to stay above for now and perhaps eventually test up toward the pivot level. All that, of course, would depend on what happens as more orders come into the market as the minutes/hours wear on. This was still pretty early – just before 2AM EST. And support and resistance levels do tend to hold a bit better in lighter trading hours, so this was another factor in my decision. And the price action was decent. You can’t really tell from the diagrams, but price was holding pretty steadily on 1.36153 so I decided to get into it. The odds were definitely better than 50-50, probably right around 60%. Those types of bets will make you money in the long-run.

The entry candle did fall below support 1, but the three following candles were all bullish and led to a good five-pip winner. And that’s not a bad margin at all for 2AM.

After this, I had considered potential put option set-ups at the pivot level. But it never made it up there. I was even considering a put option trade on the 2:45 candle had it gotten up a bit higher due to the clear congestion and suggestions of reversal. The reversal did occur, but I simply wasn’t able to get into an entry point of my own choosing.

Following, I considered further call option set-ups along the support 1 level. But price simply meandered up and below the level, showing indecision and no clear indication of what the pair wanted to do. Based on the failure to reach up to pivot, I felt that the EUR/USD would eventually fall below support 1 to make new lows because the buying didn’t seem sufficiently robust if it’s reversing in the middle of a pivot point channel.

This did occur at just after 4:40AM EST when price dipped below support 1 for over six hours before a wave of buying came in the New York morning session around 10AM to boost it above the pivot level.

Overall, a 1/1 ITM day.