Early Morning Binary Trading on the GBP/JPY

June 24, 2014

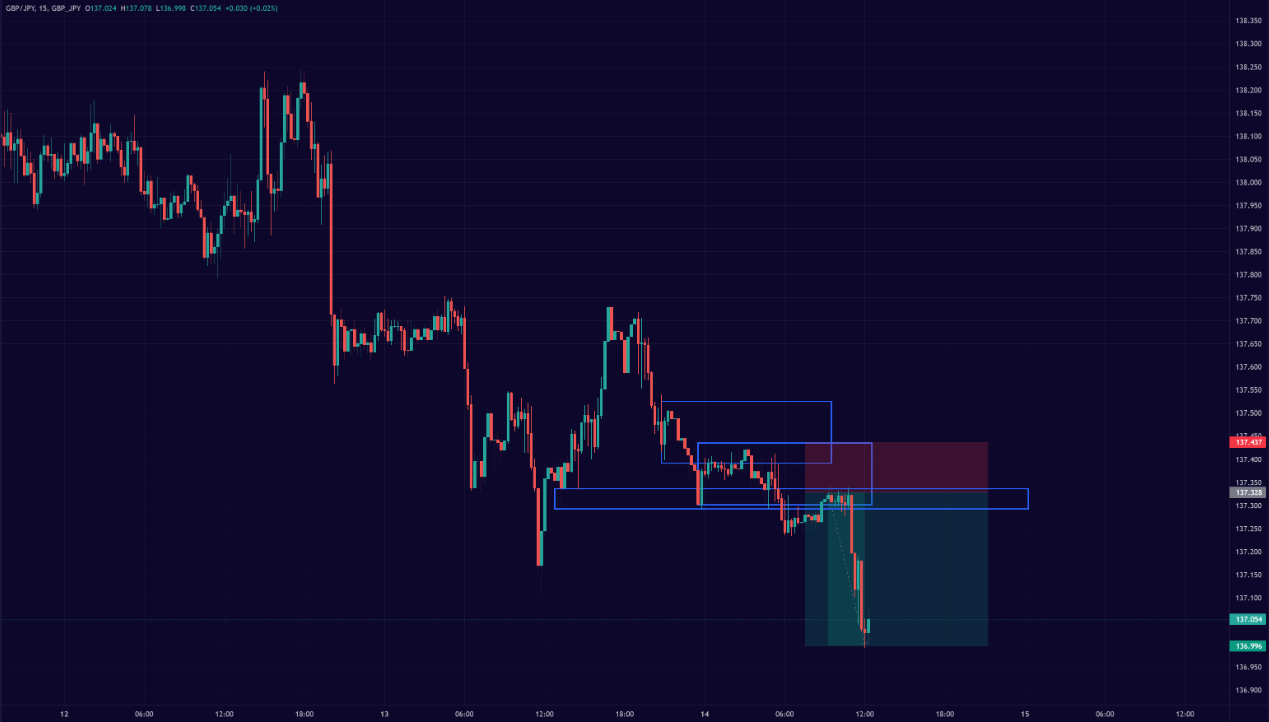

Due to the insipid early-morning activity on the EUR/USD, I began looking at five-minute charts of a few other currency pairs and eventually settled on observing the GBP/JPY, which appeared to be in the midst of providing a good trade set-up. So I scrapped the euro-dollar for the day and went with the pound-yen instead to potentially take advantage of an immediate and likely better set-up.

The GBP/JPY was down for the day, falling down below both its resistance 1 and pivot levels in the early European market hours and beginning a pullback toward the daily pivot level 173.219 just as I began watching this market after 6AM EST.

Once this pair hit the pivot level around 6:05AM EST, it did provide a bounce and close back under. The next ten minutes, as you can observe from the candles in the image below, the pair did spend some time hovering above the pivot, but from watching it live it was clear that the sellers in this market were still strong enough to hold off any buying at this particular intraday level. It eventually fell back down below 173.219 by about ten pips before retracing back up.

Given that the GBP/JPY had already shown strong resolve in holding at the pivot and was in a net downtrend for the morning, I felt I had a strong set-up to go off of and would strongly consider a put option at the first touch of 173.219.

These are three very strong factors to support a trade set-up: 1) a trend that’s in your favor, 2) a price level – in this case a resistance level – supported by an important intraday pivot point (the pivot level), and 3) recent price action, where the GBP/JPY saw congestion at the pivot.

And one thing about the GBP/JPY for those who trade it or may consider trading it, is that it’s a very volatile pair and can move quickly. Especially during European trading hours and during the U.S. morning session. It can suit personality types that are suited to those who prefer fast-paced pairs. In fact, I know of one trader who makes his trading career spot trading the GBP/JPY exclusively. I have done some trading on it in the past back when the EUR/USD, GBP/USD, EUR/JPY, and GBP/JPY were all the highest-payout pairs on 24option.

When price came back up to the daily pivot level on the 6:45 candle, I pulled the trigger on a put option, expecting it to stay under 173.219 at least until the top of the hour. This pair was entering into some channel trading, oscillating back and forth in a ten-pip area for the past hour by that point. I was hoping it would continue to do that during my trade by receding into the “valley” part of the pattern. Fortunately for me, it did and I won this trade by about three pips. That doesn’t seem like much, but it was in my favor the entire time and was slow and steady in the intended down direction.

And with that, I am back in-the-money since resuming my binary options trading, with 3/5 ITM. Hopefully I can maintain that going forward.