60-second trading and 10-minute options on the EUR/USD: 6/8 ITM Overall

I had limited time to trade on Monday, so I decided to dedicate today’s trading to some 60-second options on the EUR/USD back at Trade Rush. At the same time, I took standard 10-minute trades on the pair at Markets World.

No pivot points were in play for me today, although I did have a 23.6% Fibonacci retracement line available from the 1.20411-1.37104 price move I have drawn in on the weekly chart. So basically it was up to me to find support and resistance levels mainly from the price history alone.

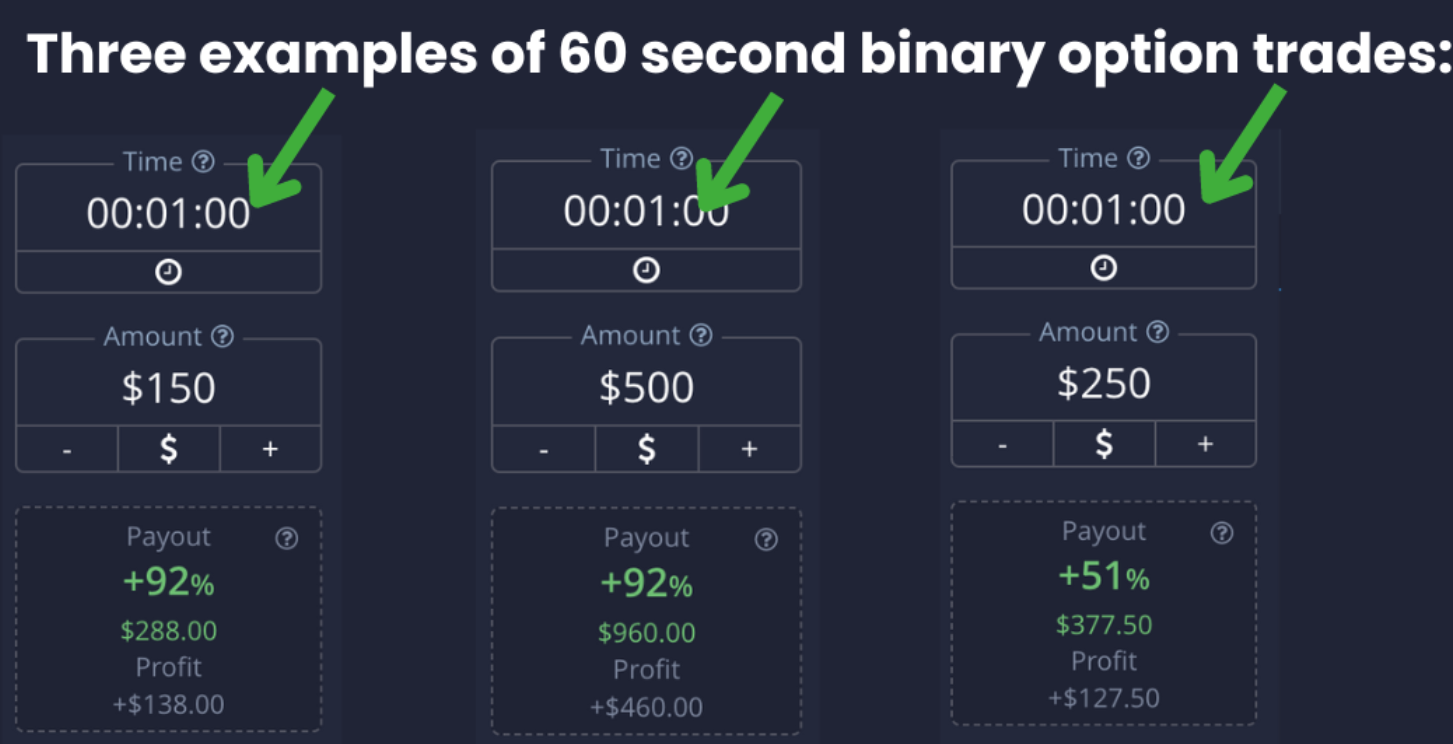

Let me first discuss the 60-second trades

#1: I started watching the EUR/USD charts around 12AM EST, but my first trade of the day didn’t come until the 1:33 candle. My first set-up could have occurred back on the 0:50 candlestick (12:50AM EST) on the re-touch of the 1.33267 resistance level. However, my price feed tends to occasionally act weirdly on the one-minute chart, so I wasn’t able to get into a put option on that one. But I did like the call option set-up on the 1:33 candle a bit better, due to the support level that had neatly formed at 1.33218 just after midnight EST. I took a call option on the first touch of the level and had a winner.

#2: My second trade came back up at the 1.33267 resistance level, where I took a put option on the 1:56 candle. This also saw an immediate bounce and I ended up with a winning trade here, as well.

At this point, in my one-minute trades, I do not take trades on multiple touches of the same level in rapid succession. In other words, although price hit 1.33267 on the 1:56 candle, I decided not to also take trades on the subsequent re-touch of the level on the 1:58, 1:59, and 2:01 candles. Granted, all four trades would have worked out here, instead of just the one. But my current line of thinking is that if you take multiple trades at the touch of a level in back-to-back candles and the level fails, you’ll likely be stuck with two losing trades. But I’m going to have to do some research if taking multiple trades at the same level in rapid succession is a profitable 60-second strategy using multiple days of previous price data.

#3: This trade was another call option back at 1.33218. Price came down and re-touched the support level on the 2:16 candle. This trade spent most of its entirety out-of-the-money, but the support level held and was able to get a slight winner out of this one.

I did not trade this same spot again on the 2:34 candle (marked as the first “No trade here” in the above screenshot). I was looking for the pair to get back up to previous resistance at 1.33267, but it did not quite reach that point in the market (“weak retracement”) and made a series of lower highs on the way down. This is, in a sense, a typical market pattern that indicates that a breach of support could occur.

The break of support did not occur immediately and that 2:34 60-second call option trade would have worked out. But the breach of 1.33218 to the downside eventually did occur on the 2:38 candle.

#4: This call option was a simple touch of the ever-important 23.6% Fibonacci retracement level (relevant to 1.20411-1.37104). This 60-second trade did not work out, but I was able to get into a 10-minute expiry trade at this level minutes after, as I’ll explain below. Overall, the Fibonacci level held well and ended up being the low for the entire trading day. But 60-second options do have a decent amount of randomness to them due to the brevity of the active trade span.

#5: I did not take a put option trade at 1.33218 due to the high level of momentum. I also did not take any trades around the 1.3324 price level that occurred in that general consolidation area between 3:00-3:30AM. Regarding the latter area, I didn’t not trade the area because I found something wrong with put option set-ups there; I simply didn’t recognize how good of an opportunity it was until the consolidation had passed, and it continued up higher to 1.33267 once again. I suppose I just wasn’t watching as actively as I should have been, so that was a mental mistake on my part.

I did, however, take a put option on the 1.33267 level for the second time today. I did not trade the initial touch of 1.33267 as I was cautious of the upward momentum that was occurring. So I decided to take the put option after the initial rejection of 1.33267. Nevertheless, price swiftly moved above my entry and I ended up with a losing trade here.

And as I mentioned earlier, I also traded 10-minute expiries on the EUR/USD from the 5-minute chart at Markets World. For these trades, I used the same price levels I was using on the 1-minute chart – 1.33267, 1.33218, and the 23.6% Fibonacci retracement level of 1.33164. As a result, I traded in the same price areas as the 60-second trades, although I took these 10-minute trades only until the price had been previously rejected on a prior five-minute candle.

My first trade came on the 1:35 candle using 1.33218 as support, as created from the 0:05 (12:05AM EST) candlestick. Price had previously rejected the level on the 1:30 candle, leaving me with a call option set-up on the 1:35. This trade finished three pips in favor.

After that, as seen from my 60-second trade rundowns, the market advanced back up to the 1.33267 resistance level, where it was rejected on the 1:55 candle. Naturally, on the re-touch of 1.33267 on the following candle, I took a put option and wound up with another three-pip winner by expiration.

My final 10-minute trade of the day came down on the 23.6% Fib level (1.33164). Although this trade did not win for me on the 60-second expiration, I was able to get a winner on the 10-minute expiry. After the clear breach of 1.33218 on the 2:35 candlestick, price touched the 23.6% Fib on the 2:40 and wicked back above, demonstrating a clear sensitivity to that price. I took a call option on the re-touch of 1.33164 on the 2:45 candle and had a relatively pain-free two-pip winner by expiration.

I went 3/5 in-the-money on the 60-second options, but a perfect 3/3 ITM on the 10-minute options. Obviously, with the 10-minute options I was using a 5-minute chart, which is a cleaner time compression overall than the 1-minute. Also, I was using my usual touch-reject-retouch price action strategy to take trades at support and resistance levels to better confirm how robust they seem to be, which helped to ensure better accuracy.

As always, if you have any questions or comments, please leave them below (or visit me on the forum) and I will get back to you promptly.